Episode 78: Building Height and Construction Costs with Anthony Orlando

Episode Summary: Building taller lets us fit more homes on valuable urban land, but more homes doesn’t necessarily mean more affordable. Anthony Orlando joins to share his research on why taller isn’t always better — and the circumstances where it definitely is.

Abstract: We estimate the marginal cost and break-even rent of developing multifamily apartment buildings in the 50 largest cities in the United States using a novel data set of required construction inputs of standardized assemblies. We find nonlinearities in the marginal cost curve at the fourth and eighth stories that directly impact a developer’s returns to scale with respect to height. This curve allows us to identify a developer’s maximum willingness to pay for land for each building height, which we then compare to existing single-family land prices to determine whether new multifamily development will occur. The analysis concludes by simulating the impact of height regulations on break-even rents of new supply. We find that height regulation often has large, negative effects on housing affordability, with increasing magnitudes for more expensive land markets.

Show notes:

- Eriksen, M. D., & Orlando, A. W. (2022). Returns to Scale in Residential Construction: The marginal impact of building height. Real Estate Economics, 50(2), 534-564.

- Episode 69 of UCLA Housing Voice, with Mike Eriksen discussing the Low Income Housing Tax Credit and “Crowd Out”

- Giuliano, G., Redfearn, C., Agarwal, A., & He, S. (2012). Network Accessibility and Employment Centres. Urban Studies, 49(1), 77-95.

- An, B., Orlando, A. W., & Rodnyansky, S. (2019). The Physical Legacy of Racism: how redlining cemented the modern built environment. Available at SSRN 3500612.

- Eriksen, M. D., & Orlando, A. W. (2024). A Cost Decomposition of Break-Even Rents for New Multifamily Housing Development. Journal of Housing Economics, 102012.

- “Spatial markets often exhibit increasing returns. Firms can minimize transportation costs by colocating, thus making it more efficient to concentrate in the industrialized “core” than to spread out across the agricultural “periphery.” This density, in turn, necessitates verticality, but the associated costs of growing taller are poorly understood (Ahlfeldt & McMillen, 2018). This marginal cost curve can help explain the wide variation in building height both within and across cities, including discontinuous gaps in each city’s skyline (Ahlfeldt & Barr, 2020; Jedwab, Barr & Brueckner, 2020), as well as the declining affordability of multifamily housing in most urban centers (Glaeser & Gyourko, 2018). In this paper, we use novel data on required building components and local input prices to estimate this marginal cost curve—and the resulting break-even rents (BERs) of supplying new multifamily buildings—in the 50 largest cities in the United States.”

- “The marginal effect of building height plays an important role in the decision to substitute between land and nonland inputs. This is the first-order trade-off that developers face in the standard urban model. The greater the cost of each additional story, the more they will choose land over capital—and therefore, horizontal over vertical expansion. Thus, it is not surprising that recent models, for all their sophistication, estimate a unitary elasticity of substitution between land and nonland factors when they assume constant returns to scale in residential construction (Ahlfeldt & McMillen, 2014; Epple, Gordon & Sieg, 2010).”

- “It is not clear whether this finding generalizes to all residential construction … Constant returns to scale may hold at the lowest heights of construction—and indeed, according to the nonparametric estimates of Combes et al. (2017), that appears to be the case—but this assumption seems insufficient to explain the proliferation of tall buildings across the globe, both in isolation (Sullivan, 1991) and in proximity to other tall buildings (Barr, 2012). Why is vertical construction, at the same time, both ubiquitous and idiosyncratic?”

- “The main innovation of our research is to estimate returns to scale in residential construction directly using novel data on the mixtures of required building components called “assemblies” as determined by engineers when establishing universal building codes. We use these assemblies and local input prices to directly estimate how varying attributes, such as building width and height, affect the costs of supplying a new building and a resulting developer’s willingness to pay (WTP) for land. This differs from earlier research focusing on the supply of single-family housing because we can isolate the marginal effect of building height on construction costs across location and building typology. Then, using ZIP code-level data on local land costs provided by the Federal Housing Finance Agency (FHFA) and housing rents from CoStar, we estimate for each city how hypothetical regulations impact housing supply by reducing a multifamily developer’s ability to compete with single-family owners for land and requiring higher expected rents from tenants before new developments will occur. We define these minimum expected rents before new development occurs as “break-even rents.””

- “Based on national average prices of inputs in 2018, we find per square foot costs of construction for a 2-to-12 story multifamily building on an acre of land range from $131 to $195, depending on building height and composition. Importantly, these costs do not change monotonically as building height increases. Instead, we detect local minimums. Often, costs decrease with additional stories before increasing sharply and discontinuously due to changes in engineering requirements. Where these discontinuities occur, namely, the fourth and eighth stories, reveal important technological factors in the production function. While the discontinuity at the fourth story is widely recognized due to current code requirements limiting the height of wood-framed buildings, the second discontinuity due to required changes in substructure composition is several magnitudes larger and less well understood. In contrast, expanding a building’s horizontal floor plate monotonically reduces costs on a per square foot basis.”

- “While developers should always extend the horizontal floor plate to the greatest extent possible due to increasing returns, local input prices and rents determine when and where additional stories increase returns. In 13 of the 50 largest cities in United States, the marginal cost of adding a second story is so high relative to the average market rent that multifamily developers are outbid by single-family owners in at least the median-priced ZIP code. Of course, this is not true in all ZIP codes in these cities, but it underscores how local variation in rents and land values creates heterogeneity in developers’ preferred building heights, both across and within metropolitan areas. In 24 of these cities, unconstrained developers would bid the highest for land to develop seven-story construction in the median-priced ZIP code, and in eight cities the highest bid in the median-priced ZIP code would be for developments of 12 or more stories.”

- “Similarly, the negative impacts of height regulations are significantly varied across cities and could be substantial in some markets. In addition to a mechanical reduction in the quantity supplied of housing, imposing height restrictions could also increase the minimum, or break-even, rent developers would have to expect to receive for new development to occur. This could result in land remaining underdeveloped, resulting in a further reduction in supply and upward pressure on rents. The increase in minimum or BERs due to a four-story height constraint ranges from 5% to 21% in the median-priced ZIP codes of the 24 cities where seven stories are associated with the highest land bids by unconstrained developers—and up to 56% in the eight cities where 12 stories are preferred.”

- “Unconstrained decisions by real estate developers are unobserved. If we only use data from existing buildings as previous literature has done, we therefore introduce sample selection bias, censoring all possible building assembles that were available in the housing production function but were not chosen by the developer. Our innovation to overcome this challenge is to use standardized building assemblies and cross-sectional data on the prices of inputs to simulate the construction of similar buildings across space to measure the effect of slightly varied inputs and imposed constraints on a development.”

- “RS Means provides the primary source of data in the analysis … using RS Means’ Square Foot Estimator, which has been available to generate estimates using an online portal since 2007. This estimator allows users to specify parameters of a building’s attributes, including square footage, building stories, story height, linear feet of the building’s perimeter, quality of fixtures, and presence of basements and elevators. It also allows the user to specify whether union labor will be used to construct the building. Using these parameters and the building’s purpose (e.g., multifamily residential, office, and industrial), the estimator allows the user to select from prespecified combinations of framing and exterior shell materials called “assemblies,” defined as permissible and complete structures meeting universal building codes under the Uniformat II standards set by ASTM International (Charette & Marshall, 1999). The output of the estimator indicates the quantity of individual components and total price to install all the components in the local market, given specified parameters and selected building assembly.”

- “In this paper, we focus on apartment buildings ranging in height from 2 to 12 stories with an elevator and average fixture quality. We focus on apartment buildings with 12 and fewer stories because (a) single-story rental apartments are rare and less comparable to taller assemblies with an elevator and (b) local idiosyncratic factors (e.g., wind shear, earthquakes) significantly increase the cost of construction in some areas with the greatest impact on buildings taller than 12 stories … To aide in comparison across structures and regions, we define a story height to be the industry standard 10 feet, assume no presence of a basement, and set the building’s shape as rectangular such that the building’s perimeter is double the square root of the floor plate (Sturtevant & Sykes, 2011). We also define design, engineering, and contractor overhead costs to be an additional 25% of the structure costs, which is approximately the midpoint of publicly available estimates as of 2018.”

- “We first focus on costs based on average national input prices in 2018, and then we explore the variation across the 50 most populous cities in 2018 according to the US Census Bureau. Table 4 lists these 50 cities … The majority of the analysis will focus on buildings with a 10,000-square-foot floor plate, which is approximately what would fit on an acre of land in most markets.”

- “In this section, we estimate vertical and horizontal returns to scale for residential buildings excluding fixed land costs. We begin by estimating the costs of different assembly types to underscore the importance of controlling for this variation in our main analysis. We then calculate the average and marginal cost per square foot with respect to building height, and we compare these findings to the estimated horizontal returns to scale by calculating the marginal cost per square foot with respect to assembly type and floor area.”

- “As anticipated, there is substantial variation in average construction costs per square foot of multifamily apartment buildings, even holding the number of stories and size of floor plate constant. Table 1 documents these costs in more detail for each assembly with a 10,000-square-foot floor plate based on national average prices of inputs in 2018 … The average cost per square foot of those assemblies is $162, ranging from a minimum of $131 for three-story construction to a maximum of $195 for eight-story buildings.”

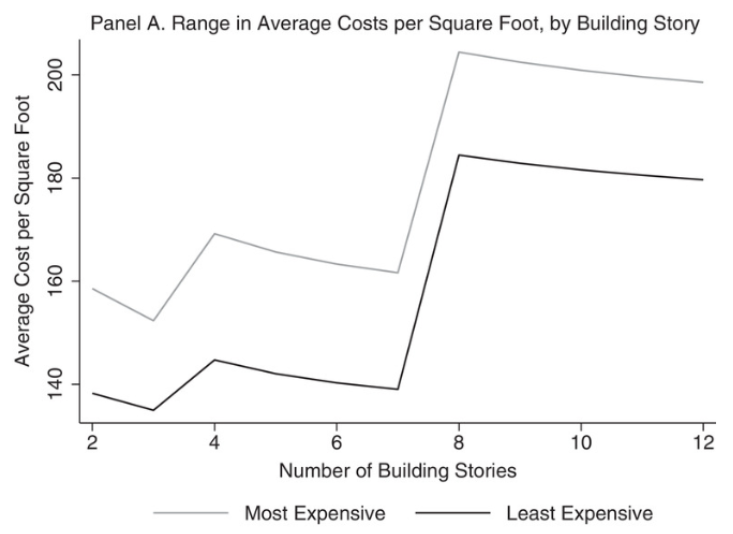

- “Panel A of Figure 1 illustrates this range in average costs per square foot within stories. For two to three stories of construction, the least expensive structures are wood-framed with a fiber-cement exterior shell. The most expensive are concrete-framed structures with a brick exterior, commanding a 13.4–12.2% premium, respectively. The range in average cost per square foot is greatest for four- to seven-story buildings, and the least for 8–12 stories. Steel-framed structures with an EIFS shell were the least expensive assemblies for buildings taller than four stories, and structures with a concrete frame and exterior shell are the most expensive for these building heights. On average, dual concrete structures between four and seven stories were approximately $20 more per square foot, or 15% more expensive than EIFS and steel assemblies, which decreased to a $16 difference per square foot, or 9% for 8- to 12-story buildings.”

Figure 1, Panel A:

- “Panel A of Figure 1 illustrates significant increases in average costs occur for both the least and most expensive assemblies when the building grows from three-to-four and from seven-to-eight stories. Holding the assembly constant, there is a $41–$44 difference in average costs between least and most expensive building story, with eight-story construction being universally the most expensive. This means there is almost double the variation in average costs across building heights than assemblies, and that earlier studies assuming constant construction costs have missed an important source of variation. It is the infrastructure and technology required to build higher, rather than the building materials per se, that poses the larger marginal constraint.”

- “Panel B of Figure 1 illustrates the marginal increase in cost per square foot to add an additional story of the least expensive building assembly. Besides those two positive and significant jumps at four and eight stories, marginal costs of adding a story are otherwise small and negative. Average costs increase 8% from three to four stories and 32% for seven to eight stories. The first increase from three to four stories is attributable to shifting from the limits of wood-framed construction to the least expensive four-story assembly (i.e., steel-framed construction with an EIFS exterior shell). The second increase in marginal costs at eight stories is less well understood.”

- “Because our cost estimates are constructed from engineering data with detailed information on individual components, it is possible to peek inside the production function to explain how the infrastructure and technology are changing at different heights to explain the increase. Figure 2 shows costs per square foot of the five components to construct a multifamily building based on national average of input prices: equipment, interiors, shell, services, and substructure.

- “At the three- to four-story cost increase, there is a small increase in the shell cost, a larger increase in the services cost, and a partially offsetting decrease in the cost of the associated substructure. An examination of individual required components reveals three new inputs associated with four-story construction are responsible for this increase. First, there is a change from a traction elevator using a pulley system, moving at 125 feet per minute, to a hydraulic elevator using a fluid-driven piston, moving at 200 feet per minute. Second, there is the introduction of a fire pump and wet standpipe risers to supply pressurized water to the top floors. Third, there is a switch from overhead electrical service installation with an 800-A service to underground installation, which requires excavation, back-fill, and compaction, with 2000-A service. Underground service is more reliable and less expensive to maintain but more expensive to install—and therefore becomes more economical at greater scale.”

- “At the seven-to-eight-story cost increase, there are significant increases in both services and substructure costs. We find that the services costs increase is primarily due to another elevator upgrade, from a speed of 200–350 feet per minute. There are also smaller cost increases due to a more expensive fire pump and wet standpipe risers, requiring three times more horsepower to supply twice as many gallons of water per minute. At eight stories, the electrical installation and fire alarm systems also become more expensive. The biggest cost increase at almost $20 per square foot, however, comes from the substructure, which requires the addition of expensive steel beams, known as H-piles, to support the additional weight of the structure.”

- “Panel A of Figure 3 illustrates the average cost per square foot to construct 3-, 7-, and 12-story buildings with floor plates between 6000 and 30,000 square feet. These assemblies represent buildings with total square footage between 18,000 and 360,000. In contrast to building height, average horizontal cost per square foot decreases monotonically with the size of the floor plate. Panel B of Figure 3 illustrates this marginal decrease in average costs per square foot associated with adding 1000 square feet to the floor plate. The marginal decrease is similar for all three building heights, and it diminishes for larger floor plates. Adding an additional 1000 square feet to the floor plate lowers the average costs by approximately 1.5% for assemblies with a 6000-square-foot floor plate, but less than 0.1% for buildings with a 29,000-square-foot floor plate.”

- “Regional variation can help us understand the relationship between these average and marginal costs. In Figure 4, we focus on the marginal cost of adding a story to existing 3, 7, and 11 stories of the least expensive assembly on a 10,000-square-foot floor plate. The average cost per square foot appears on the x-axis, and the percent increase in average costs of an additional story appears on the y-axis … A clear negative relationship exists between average and marginal cost, as displayed by the slope of the solid line in Panels A and B, although the fit is the greatest when increasing from three to four stories. This means, unsurprisingly, we are likely to find that the least expensive cities have fewer buildings that exceed this height.”

- “In this section, we quantify the effect of maximum building height limitations in two ways. First, we take the average market rents as given and calculate a developer’s maximum WTP for land to construct buildings of different heights. This estimate indicates not only the height endogenously selected by unconstrained developers with the highest bid, but also whether it exceeds existing land prices of single-family housing development to determine whether any multifamily development will occur. Regulatory height restrictions are more binding and potentially inefficient in areas where they diverge more significantly from the developer’s preferred building height. Second, if we alternatively take the average land prices as given, we can calculate the lowest or BER that a developer must charge for new development to occur at a given height. We can show how the BER is directly affected by binding regulatory height restrictions—and by extension, the marginal effect of height regulation on housing affordability.”

- “We first present maximum land bids using national averages, and then for ZIP code in each of the 50 largest metropolitan areas with the median price of land based on local input costs and tenant rents. Figure 5 shows a developer’s maximum WTP for an acre of land based on national averages for three different scenarios: average annual expected rents per square foot of $12, $18, and $24. The average rent per square foot in the median-priced ZIP code across the 50 cities was $17.64 using data provided by CoStar. Across the 50 cities, annual market rents per square foot ranged $7.68 in Buffalo, NY to $50.16 in San Francisco, CA.”

- “When expected rents are sufficiently low, the maximum land bid by multifamily developers is always negative and declining. In these markets, new multifamily housing developments will not occur, and the land will remain at its current use. The bottom line of Figure 5 represent this negative and declining pattern based on national average input prices in 2018 and expected rents equal to $12 per square foot … This pattern suggests new multifamily development will not occur even with free land … When expected rents are near the average of the 50 cities at $18 per square foot, land bids are positive and generally increasing for multifamily buildings with two to seven stories based on national average prices of development inputs. This pattern is displayed by the middle line in Figure 5 where seven stories of development is associated with a higher bid than three stories. There is only a minimal decrease observed with a four-story development … At eight stories, there is a significant decrease in the maximum WTP for land, as compared to seven stories, due the sharp increase in marginal costs.”

- “When rents are sufficiently high, the maximum land bid is always positive and mostly, if not strictly, increasing. The top line in Figure 5 represents an example of this type of bid function, with national input prices based on national averages and $24 per square foot in expected rents, which represents approximately the 90th percentile of rents across the 50 cities. While a local maximum in WTP is achieved at seven stories, another local maximum is calculated to occur at 12 stories. This pattern results in a “donut” pattern of development, where a hole in building height effectively exists, with no development occurring between 8 and 11 stories for this example. In eight of the 50 largest cities, the highest bid would be associated with 12-story multifamily developments, and in all instances, the developer’s WTP would exceed single-family land values in the median-priced ZIP code.”

- “In this subsection, we alternatively solve for the BER, or the lowest expected rent for new development to occur at different building heights. The first column of Table 3 shows the BER of the least expensive assembly not incorporating fixed land costs using Equation (7) and national average input prices. These estimates vary from $13.24 per square foot for a three-story building to $18.10 per square foot for an eight-story building. These calculated minimum rents are in annual terms. They translate to monthly rents of $1091 and $1491, respectively, for a 1000-square-foot apartment before accounting for the cost of land.”

- “The second column of Table 3 indicates the BER if the same building was constructed on an acre of land acquired at the national average price, which was estimated to be $633,500 in 2018 by the FHFA. This implicitly assumes developers can acquire land at the single-family value and therefore represents the minimum BER, or expected price before new development would occur … As anticipated, the fixed cost of land increases the BER of the shortest buildings the most. Figure 8 illustrates these BER estimates, where the bottom line ignores land costs and the top line incorporates the average cost of land. Based on the average cost of land, the minimum profitable rent of a two-story building increases by 22.8% to $16.67 per square foot, whereas the BER of 12-story construction only increases by 3.0% to $18.2 per square foot.”

- “The last three columns of Table 4 indicate regional BERs for 3-, 7-, and 12-story construction. The BER is the highest in San Francisco, CA, for each of the three heights, despite higher construction costs in New York, NY. In San Francisco, the BER per square foot is the highest for three-story construction ($52.3) and lowest for 12-story construction ($28.0). These BERs translate to monthly rents needing to exceed $4358 and $2333 for new construction to produce 1000-square-foot apartments at each height in the median-priced ZIP code, respectively. This inverse relationship between building height and BER is a result of high land prices, as developers can spread the acquisition costs over more units in taller buildings.”

- “Potential negative effects of building height limits depend on whether they are binding and actually constrain developer behavior … Two main effects on housing markets are possible from the imposition of building height constraints where binding. First, there is a mechanical reduction in the aggregate supply of housing on a given parcel of land, although this could be even greater than the imposed constraint … [For example, g]iven the increase in marginal costs from three to four stories, imposing a four-story constraint could lead to an additional 25% reduction in quantity of housing supplied in some markets, as developers of three-story buildings would have a higher WTP for land.”

- “The second effect of imposing binding height limits on developers is that the BER increases, resulting in higher rents paid by eventual tenants, holding profits constant. The x-axis of Figure 11 represents the BER for supplying 7- and 12-story buildings, and the y-axis represents the increase in BER by imposing a four-story height maximum … The increase in BER where seven-story buildings are preferred by unconstrained developers ranges from approximately 5% in San Antonio, TX, to over 21% in New York, NY, as a result of the height limit. For New York, this results in monthly minimum rents for a 1000-square-foot apartment increasing from $1918 per month to $2325. The average increase in BER across the 24 cities in Panel A due to the imposed height constraint is 7.8%. The effect of a four-story height limit on the eight cities in Panel B where 12 or more stories are preferred by unconstrained developers is more varied. The largest increase in BER per square foot due to the constraint is in San Francisco, CA (56.1%), while there is virtually no increase in Boston, MA (less than 0.1%).”

- “These findings have important implications for local policymakers. Most major US cities have height limits that restrict the number of stories a developer can choose in construction. Building on the classic urban model where profit-maximizing developers choose the optimal level of capital for a given set of price parameters, we show that these regulations often result in supply decisions that deviate from this optimal level … This marginal effect of height regulation is sizable—and it becomes increasingly burdensome for cities with more expensive land. In order to cover higher land costs with fewer stories, developers have to charge a much higher rent per square foot.”

Shane Phillips 0:04

Hello, this is the UCLA Housing Voice podcast, and I'm your host, Shane Phillips. This week, we're joined by Anthony Orlando to share some very important and illuminating work he's been doing on the relationship between building height and construction cost. Taller is often better from an affordability perspective, but the context really matters. Sometimes a three- or four-story building produces less expensive units than seven stories, and in many cases, seven stories can be built more affordably than ten or twelve. This research helps explain why that is, why newer developments often don't build to their maximum height, and what this all means for housing affordability. I honestly think this research deserves the attention of every housing policymaker and urban planner, here and abroad, so I'm very excited to bring it to all of you, and I'm just going to jump right in.

The Housing Voice podcast is a production of the UCLA Lewis Center for Regional Policy Studies with production support from Claudia Bustamante and Gavin Carlson. Summer is wrapping up, and fall quarter is starting at the end of September, so we are going to take a break from publishing over the next month, and we'll be back in mid-October with some great new episodes. In the meantime, you can always email me with show ideas, comments, or questions at shanephilipsatucla.edu. With that, let's get to our conversation with Anthony Orlando.

Anthony Orlando is an associate professor in the finance, real estate, and law department at Cal Poly Pomona, and he's joining us today to talk about his research into the relationship between building height and construction costs. In line with practice, he finds big leaps in construction costs at four and eight stories tall, and we're going to talk about why that is, how it affects the financial feasibility of development, and what lessons it has for how we plan our cities. Anthony, thanks for joining us, and welcome to the Housing Voice podcast.

Anthony Orlando 2:13

Thanks for having me. I'm excited to be here. I've been working for a while. It's kind of fun to be on.

Shane Phillips 2:18

Glad to finally have you on the show. You publish a lot, so I just had to find the right paper. I do not have a co-host today. We had a bit of a scheduling conflict, but it's just going to be one-on-one here today. The topic of the conversation today is a journal article in Real Estate Economics that you published in 2022 titled, “Returns to Scale in Residential Construction: The Marginal Impact of Building Height.” Your co-author on this one was Mike Eriksen, who we actually had on the show a few months ago to talk about the low-income housing tax credit and the circumstances where subsidized housing development can crowd out unsubsidized development. That was episode 69.

This topic, the relationship between construction costs and building heights, is something I've wanted to discuss on this show for a long, long time because it informs so much about the built environment of our cities. Others might imagine that a five-story, 50,000 square foot building costs half as much as one that is 10 stories and 100,000 square feet. If that were true, then we could always reduce the cost of building new housing on a square foot basis by building taller. But for reasons we will get into, the construction cost of that 10-story building is usually much more than double the cost of the five-story building. Costs do not just increase linearly as you add more floors to your building. For example, going from three stories to four is a 33% increase in size, but reaching that building height triggers different building code requirements that might raise your costs by 50% or more. Something similar happens between the seventh and eighth floor, so building a seven-story apartment might cost 15 or 20% more than a six-story building, but an eight-story building might cost 50% more than a seven-story one. If you have ever wondered why all the new multifamily buildings in your neighborhood seem to cap out at roughly the same height, often around three or seven stories, this is a big part of the answer, the marginal cost of construction by building height. All of this determines the rents or sale prices that developers need to bring in to build housing profitably, which in turn affects how much housing gets built and what we all pay for it.

So in this paper Anthony and Mike introduce a novel way of estimating the marginal cost of adding more floors to buildings in different regions of the US. They then use those estimates to identify the minimum rents needed to justify construction at different heights, what they call breakeven rents, finding that developers need to charge about 30% higher rents for an eight-story building compared to a seven-story building to earn the same profit. To complicate things further, costs per square foot actually fall as you add floors between these breakpoints, so the rents needed to justify a 12-story building are probably somewhat lower than for an eight-story building. There is a lot to talk about here, both on the theory side and just in terms of real world cost estimating, so we're going to get into it. Back to you Anthony, I think the best place to start might be with a quick explanation of the standard urban spatial model that planning and real estate professors like you teach their first-year students. Could you tell us what that model is and what it predicts about the form our cities take and then where it falls short, especially with respect to height?

Anthony Orlando 5:44

Sure. I think it's a great place to start both because it's useful and because it has huge flaws. It's useful because it helps us understand some really important things about the world, but sometimes that's also the downside of a model is it doesn't help us see certain things and so we have to go outside the model and that's what we did here.

Okay, when you're teaching a class on real estate or urban economics, urban planning and you want to talk about how to model the way a city should look, often you start with two things. One is the idea of agglomeration, right? This is the idea that people and firms are more productive when they're located near each other and that means that you're likely to have a very concentrated area where all the jobs are located and we could go into a whole other conversation, which I know you've done in the past on that, but yes, there's lots of evidence that when people and firms are located near each other, there's a lot of productivity benefits and so it's not surprising that we have downtown areas where we don't all work separated from each other. We want to be close together. We benefit from the idea spillovers and all those sorts of things.

The second component of a model like that is transportation costs. So if you're going to have a downtown where most of the high-wage, high-productivity jobs are located, now the next question is where are people going to live relative to that and the major thing in the workhorse urban model that's going to govern that is transportation costs. That the closer you live, the less you have to pay for transportation, which means the more money you have left over to pay for land and therefore for housing and the further away that you live, the more you have to pay for transportation and so the less money you have to pay for housing.

And so what that means is the closer we are to the downtown area, the more valuable the land is going to be and because the land is more valuable, more people are going to want to live there. We're going to have to build taller buildings in order to pay for that land and have more tenants located on top of that land and so we should have taller buildings. And as we move further away, as the land becomes less valuable, the land gets used less intensively. We don't have to put a lot of people on each square foot, on each acre further away because the land isn't as valuable and not as many people are going to demand to live there. And so we should see that building size decreases as we move away from the center of the city. Often this is called the monocentric city model because there's one center and everything revolves around it.

Obviously, that's not how cities look, but it's a decent approximation of how a lot of cities look. Most cities have a downtown area where there are more jobs concentrated than in other areas. Most cities have, on average, declining building height and declining land values as we move further away. Now you run into problems like if I move east instead of moving west in some cities, I find that land values are higher east than west. The model has nothing to say about that. Or I might find that as I move away, I suddenly hit a pocket of density that pops up out of nowhere and that's not part of my model. Why does that happen? That is often what we call polycentricity. And so my colleagues at USC, Chris Redfearn and Gen Giuliano have studied this in Los Angeles. Los Angeles is a classic polycentric city. Yes, we have a downtown area, but we also have a ton of density around Century City and a bunch of density around Pasadena and Santa Monica and all these different clumps of density.

Right. So now what's relevant for our research is why do we see these differences in building heights that don't seem to be predicted by the productivity of jobs locating near each other? Why do we see these differences be predicted by transportation costs and people commuting? How can we explain why cities have popped up this way? There's a few different explanations and all of those explanations reveal interesting things about how our cities have developed. One important one, for example, is historical policies. So redlining. You put a policy like redlining in place and you say certain neighborhoods can get mortgages and other neighborhoods can't, and you're going to affect the built environment. And so I did separate research with my colleague Brian An at Georgia Tech and Seva Rodnyanski at Occidental College where we showed exactly that. Another difference is transportation planning, right? Where you put the freeways, where you put the train lines is going to affect where people are able to live. Another is that you've got different kinds of agglomeration. It's not just that people want to all work in the same downtown area. It's also that retail wants to cluster near each other so that if people are shopping at one store, they can visit another store. It's that some people want to be located near certain amenities and other people want to be located near other amenities. So you might have clusters of those things in different neighborhoods.

But one of the big reasons that we think is underexplored is discontinuities in construction costs. The idea that you're not going to easily be able to just smoothly decline building size as you move further away from the city center because it's not that easy to build buildings of different heights. You encounter different problems for certain heights, and so it might be easier. Like you said, it might be easier or more cost effective to build a building with seven stories instead of eight stories, and suddenly you've got to jump if you look at the city skyline and it's not continuous. So that's one of the things that I think this paper helps to reveal.

Shane Phillips 10:54

And so if the standard model were fully accurate, and as you said, no model is accurate, but hopefully they're all useful, we would generally expect to see fewer nine-story buildings than eight-story buildings, fewer eight-story buildings than seven-story buildings, and so on. But that is not what we see in places like Los Angeles, and this is really a general finding I think, but just to use Los Angeles as an example, we end up building a lot of seven-story buildings, a fair number of towers that might be 15, 20 stories, 50 stories, and almost nothing in that eight to 15-story range, let's say. Putting aside the many 13-story buildings in places like downtown and Hollywood that were built 100 years ago when you weren't allowed to build anything taller than City Hall, we've said a little bit about why this gap in the skyline exists, and this makes it really challenging to estimate the cost of different construction types and materials because the ones that aren't economical simply don't get built.

It's pretty easy to figure out the construction cost of two-story wood frame single-family homes and three-story wood frame apartments because they're built all over the place. We can just look at the projects and what they cost to build. We don't build as many 20-story steel or concrete buildings, but they're common enough in some markets that we can draw some reasonable conclusions about their costs. To a first approximation, no one builds three-story steel frame buildings, or even five- or six-story steel buildings in most cases. We know that's because they're more expensive than wood, among other things, but it doesn't tell us how much more expensive. So first, just tell us why you believe it's important to have cost information for construction type and height combinations that rarely get built, and then tell us how you actually came up with those estimates for this study.

Anthony Orlando 12:45

Sure. So there's a couple things in there. One is something that you mentioned already, which is history. If we're trying to understand the development costs that developers are facing right now, and all we have in our data set is what has historically been built, that may no longer be relevant. The market that was facing developers 20 or 30 or 50 or 100 years ago looked very different than the market today. It might have made sense for them to build a certain type of building 30 years ago, but it doesn't make sense today. So if I'm looking at those buildings to help me understand construction costs and to help me understand why the skyline looks the way that it does as we're building new buildings, I'm trying to apply math that doesn't work anymore, right? The materials cost, the labor's costs, all have changed. Nobody would try to build those buildings anymore.

So I need forward-looking numbers, and I need forward-looking numbers where I can compare apples to apples, because as you said, there's a selection problem, as an economist would call it. The selection problem is that you essentially only observe what actually exists. You don't observe the actual problem that the developer faces in their mind. In their mind, they're considering all the possibilities of things they can build. The fact that they happen to build a certain type doesn't tell us about what those other ones would have cost. And so we can't compare the hypothetical unless we can come up with a way to create the hypothetical, to come up with an estimate of what it would have cost, and we can figure out what math the developer is doing in their heads and in their spreadsheets.

This is useful in a few ways. One, it's useful if you want to compare across time. If you want to create a construction index, Mike and I have a paper where we've done that that just came out on the Journal of Housing Economics, just came out online, that follows up on the paper that we're here to talk about, but we're doing a very similar thing there. We're trying to compare how construction costs have changed over time. Well, you want to be able to compare similar types of buildings over time, because if the types of buildings that are getting built today are significantly different in the types of materials, in the types of typology, in the size than the buildings that were built 10 years ago, then what has changed is not the construction costs. What has changed is the types of buildings. Those are two different things that you're measuring. So it helps to be able to have apples to apples to make sure I'm comparing steel to steel, I'm comparing wood to wood, I'm comparing the same types of buildings.

The second thing is if I want to compare across space. Some cities are going to build different types of buildings than other cities are going to build. So I can't say, based on just that information, whether one city is more expensive to build in than another, because we're not comparing the same types of buildings. I need to have apples to apples.

And the third one is what we're really doing in this paper, which is comparing buildings of different sizes. As we'll get into as we dive deeper into this, as you go to buildings of larger sizes, as you've already alluded to, you have much different types of materials that you're going to use. Different framing, different exterior shells, different services, different elevators and plumbing and everything changes.

Now does that mean that we should be saying that those bigger buildings are more expensive just at a first glance? Well, are they more expensive because they're different types of buildings or are they more expensive because there are those different components? Is it the materials? Is it the labor? Whatever it is really matters for how we make policy and how we do better development in the future. We need to know why there's different costs. We can't do that unless we can break it down and compare apples to apples. So how do we do that? A lot of people in the field have used the data from RSMeans. They're a wonderful data provider for construction costs. They have a square foot estimator, they call it, which essentially allows you to create, to simulate a building out of the different types of materials that you want. The different sizes, the location. You get to choose all of these things and create a customized building. They do this for 757-

Shane Phillips 16:47

Importantly, a building that would actually meet the building code, right? You just can't build whatever you like.

Anthony Orlando 16:52

Exactly. So what they're doing is, first of all, they're talking to all the people who are involved in the process. So they're talking to engineers, they're talking to developers, they're talking to suppliers, and they're getting an estimate for what all the different components of the building will cost, and not just what they cost to get the materials, but also what it costs to assemble and install the materials. So they're talking to the contractors. How much does it actually cost when you do this? Let's look at the actual numbers that you're using. And then they're making sure that when they provide a certain building assembly type, as you're saying, it conforms to the local building code. So I can't, with the estimator, I can't build a building that's tall without the proper kind of elevator, for example. It simply won't let me, right?

Shane Phillips 17:36

You just answered a question that I did have that I just want to clarify or underline for the audience that you're saying the buildings actually have to comply with the local building codes, which do differ from region to region. Each state has their own building code, many cities have their own, usually somewhat stricter building codes if they have adopted their own. And so these projects are, it's not even exactly the same project from state to state, from metro area to metro area.

Anthony Orlando 18:07

Right, right. No, that's true. To build to the same height and the same general construction type, let's say. Yeah. And we've always thought that an interesting follow-up project would be to tease out exactly how much of the differences across cities are due to differences in building codes. But we haven't- That sounds very hard. We haven't assembled the team to do that. That's a lot of work. But yes, the idea is essentially that in every market we are trying to build buildings that you actually could build, that a developer would build. And I think the interesting thing about the dataset that we create for this paper is that essentially we're creating it from scratch, right? We have all the raw data from RSMeans, but you have to go in there and pick the buildings that you want. Now, for the big statistical exercise that we're doing, we need a lot of data points. We need all the different framing types, all the different exterior shell types, all the different sizes, and all those different combinations that you can imagine amongst them.

And so what we do is we build a Python code that goes in and one by one creates all the different building types we need so that we can run that kind of a statistical model. And to our knowledge, nobody else has done that for this kind of work, so it's pretty cool. And specifically, I should say, we're focused on multifamily, right? Because we're interested in building height, we're not interested in single-family except to the extent that we're going to compare it to multifamily, but we feel that multifamily is an area that really hasn't been studied enough by folks in our field. And so this is an opportunity to add to what we know about that and to get beyond what a lot of the research says about single-family, which is useful but may not actually apply once you have bigger buildings that you have to construct.

Shane Phillips 19:38

Yeah. I think this project, this study is well-timed in part because there's a growing amount of attention being paid to building codes, I think largely because we are making progress on zoning reform. And I think you would agree that if you don't make something legal to build, then the building code for it doesn't really matter all that much. But as we move in that direction and start legalizing, you know, three-story apartment buildings, eight-story, 20, whatever, depending on the location, once these things are legal to build, then there's a question of, well, is it feasible to build just financially? And what role do our building codes play in making some types of projects more or less feasible?

The single-stair issue is one thing that has gotten a lot of attention, and I think rightly so. But I've become very interested just in the differences between the International Residential Code and the International Building Code, which, despite the name, is really just two U.S. building codes. But the Residential Code applies only to, in most cases, single-family and two-family dwellings as well as townhouses. And then everything else is International Building Code. And the construction costs are an estimated, let's say, 15 to 20 percent higher for those projects on a per-square-foot basis. And so cities that have legalized three- or four-unit buildings on every parcel—SB 9 in California did this, Minneapolis did this with their triplex zoning a while back—and the challenge there is you are, yes, you're allowing more units on this land, and that is producing some savings, but in many cases the construction costs are significantly higher, such that it actually is less feasible to build a building with three or four units than one with two. And so that's a small-scale version of this, but I think this just fits into that wider picture.

Anthony Orlando 21:34

I think that's absolutely right. I think that when I've seen a lot of new ordinances being passed or being considered for being passed to eliminate single-family zoning or up-zone in different ways, and people are worried that it's going to lead to a flood of new development, I think they're missing that point. It's critically important. But there are other rules in place. Can developers actually build what you think they're going to build? And often the answer is no, and they just haven't considered that. They think flipping that one switch changes everything, but it doesn't. It's an overlapping network of rules and regulations. You've got to consider the whole totality of it.

Shane Phillips 22:13

Yeah, yeah. Financing is another thing that comes up all the time where the loan products, both from the consumer perspective and the builder perspective, are not as developed, maybe don't enjoy the same guarantees from the federal government necessarily. To buy a five-unit or more building requires a totally different loan product than four units or less, and so that's limiting. So all of these things play a role, but it is great that we feel like we're making enough progress on zoning that it's even worth starting to look at these other issues. I don't want to bury the lead too much here, so let's get into some of the results of this analysis. In particular, I want to highlight figure one from your paper, which traces a line of estimated construction costs per square foot for buildings from two to 12 stories tall. It is not a smooth line, and it doesn't even always go up as the number of floors increases. So walk us along that line and tell us why it looks the way it does.

Anthony Orlando 23:11

Sure. Now, one of the things that I'm sure we'll talk about later is how that line differs across the United States. So I don't want people for a second to think that we're saying there's one construction cost per square foot that applies all over the place. It doesn't. This is a weighted national average that we calculate, and we then do break it down regionally. But the weighted national average shows a trend or a pattern that we find popping up in city after city, so it's extremely useful.

What you find as you trace out the average construction cost per square foot of multifamily residential is that you start with two stories, and the cost per square foot actually goes down when you get to three stories. Then it goes up when you get to four stories, then it goes down for five, six, seven. Then it goes way up for eight stories, and then it comes down for nine, 10, 11, 12. Again, we're saying average cost per square foot. That doesn't mean that a 12-story building is cheaper to build than an eight-story building. It's not. As you pointed out in your introduction to the program here, what we're talking about is the per square foot, which means we're going to add more square feet, so the size is going to go up, but the cost may not go up proportionally to the size, and that was the point that I thought you made beautifully.

The big things that are happening here, first of all, we're finding that for a lot of these transitions as you add more stories, you're experiencing increasing returns to scale. That's a beautiful thing from an economist's perspective. We go from two to three stories, and suddenly the cost per square foot goes down. That actually means that it could be more affordable to build three stories and have more housing units on a per square foot basis. That's fantastic news, but then that's not true for every transition. It's this jagged line. Why does that not happen when we go from three to four stories? Why does the cost per square foot suddenly go up, and then why does the cost per square foot go up really dramatically from seven to eight?

A couple things here, and we can drill more in detail if you want, but we do break down the components of those costs, and we find that the buildings have to change significantly as they go from one story to another. It's not the type of change that happens with every story that you add, but at a certain point you reach a tipping point. Now, some of that is because of the building codes we talked about, and some of it is just because of the physical realities of construction. As you go from three to four, one thing that changes is you often go from a wood frame structure to a steel structure or a reinforced concrete structure, and so that's one thing that's going to change. But also, a lot of the services change. A lot of the systems inside the building change that become more expensive to service a building that's taller. And then when you go from seven to eight stories, you have even bigger upgrades in that sense.

And people who work in the field, as you noted at the beginning, this is one of the things we were pleased in a way to find was that when we showed that graph to a lot of people who work in the field, it fit with what they see in practice. For a lot of them it made them happy that they weren't looking at the same data that economists always seem to assume happens, that there's just a smooth change in costs as you get bigger and bigger buildings. They go, no, these buildings are materially different once you reach certain levels, and I think it's about time that economics fits in with that practice.

Shane Phillips 26:30

Well, something that stood out to me in your paper is how wood frame buildings cap out at three stories in the cost estimate model, and you don't really contemplate, or it doesn't seem to contemplate, it might just be how it's presented, mixed structure types, like the famous or infamous five over one, which is so named because you're building type five wood construction over a type one concrete podium. It's usually five floors of wood over two or three floors of concrete. In the real world, once developers exceed seven or eight stories, the construction type changes to entirely type one and costs per square foot go way up. Your estimates still manage to capture that reality somehow, but it doesn't seem to account for these mixed construction types. Do you know what's going on there?

Anthony Orlando 27:16

We have some idea of what's going on, but we should acknowledge the limitations. Every research has it, and I remember when we first posted this paper online, one of the first things that someone posted was exactly this, well, you don't have a concrete podium and a wood frame structure on top of it, and we see those buildings all over the place in cities like Los Angeles, and so this is just another paper by economists who don't know what's going on in the real world, and it's crap, don't read it. And I thought, well- I mean, look, you have a reasonable complaint. I completely agree. I would like to measure that. We can't do it with the RS Means data. That doesn't mean that it's not worth measuring what you can measure. I always say that people who are looking for perfect research are like drunk searching under the light for their keys because that's where the light is, right? If we only limit ourselves to what we have perfect data for, we can't answer most questions in the world. So we're measuring what we can with the data that we have. I still think that's a valuable contribution.

And one of the things that we do find in all of this is we find a number of things in addition to what you're suggesting that do change as you go from three to four and then from seven to eight. So what are they? Well, like I said, the RS means data tends to have you jump from wood to steel at three to four. Another thing is the elevator gets upgraded from a traction elevator with a pulley system to a hydraulic elevator. That's more expensive. Another is you've got to get pressurized water up to those top floors. And so now you've got to put in a fire pump and wet standpipe risers. Another thing is that you often have to go from overhead electrical service to underground and digging underground electrical service is obviously way more expensive. When you go from seven to eight, you have a lot of similar things. You have another elevator upgrade that usually has to happen to get up to those top floors. You often have more expensive fire pumps. And the big thing, though, is that the substructure has to change. So we're already looking at steel structures, but now you need to have H-piles, which is a type of steel beam that is going to be a lot more expensive. And so, again, when we talk to people in the field, they say, yeah, of course, that's what we do, but nobody never really traced out the average or marginal cost curve in quite this way. So it's pretty useful, I think.

Shane Phillips 29:23

Yeah. And I think you brought up the various contributors to higher costs for taller projects. And I wonder if part of what's going on here is that, frankly, in my mind, when I thought about going from a seven story to eight or 10 or 20 story building, almost all of the cost was going from mostly wood construction to concrete or steel structure. And what you find with all those various cost components is that the services, the elevator, the electrical service, the pressurized water, are a really significant substantial contributor to the cost. In some cases, you know, roughly on par with the increase in structural costs. So could you say a little more about that or was that surprising to you? Because it was pretty surprising to me. I think maybe just in part because I don't do mechanical electrical plumbing. I'm not MEP. I'm not an architect. So I just don't see that nitty gritty day to day. But yeah, it was shocking actually to me.

Anthony Orlando 30:19

It was surprising and it wasn't surprising. So in the sense that it was surprising is that I'm not an expert in any of these types of services. I'm right. I'm not an engineer, a mechanical or otherwise. And so I wouldn't have been able to identify those things without having seen the data. And this is one of the fun things about my job is that the data reveals things that I didn't know about the world and then I learn about them. And maybe to a mechanical engineer, they're sitting here saying, duh. But as you'll see, as we get further into the paper, the value of the paper is not just showing the cost, but then using them to show what they mean for housing affordability and so on. So we're able to take that realization and use it for what economists would ordinarily use construction costs for, but previously might have been relying on poor cost data. So that's great. And the details of that were surprising to me. But the fact that that line is not smooth and is not linear wasn't surprising. And it made me really happy to see it because there's actually a longstanding debate in the field, so longstanding that most people have forgotten it.

And we said we would make most of this conversation about practice, but you'll forgive me just a second because I'm a bit of a nerd about the history of economic thought. Back in the 1950s, coming out of World War II, there were two schools of economics that were really growing, especially in macroeconomics and economic growth theory. Both of them were located in Cambridge. One was in Cambridge, Massachusetts, the other was in Cambridge, England. Both of them felt that they were the rightful heirs to John Maynard Keynes, who famously in the 1930s became the most famous economist in the world and basically put forward the theories that helped justify deficit spending to get us out of the Great Depression. And most of our modern macroeconomic theories are based on his work.

The problem with a lot of Keynesian thought is that back in those days, they wrote long wonderful essays and didn't exactly write down a lot of equations about what exactly they meant. And so there became these disagreements over what did John Maynard Keynes really mean. And one of the things that they argued about was as you increase investment in big things like buildings, is one increase the same as another? Essentially, it's not just housing, but anything. As I invest in machinery, in factories, et cetera, can I just create an equation that says I'm going to add 10% to machinery, and that's going to result in X percent of more economic growth? That'd be really useful if I could do that. The Federal Reserve would be thrilled. Economic planners all over the world would be thrilled if we could do that. The economists in Cambridge, Massachusetts, folks like Paul Samuelson and Bob Solow and Kenneth Arrow said, yes, to a first approximation, you can do that.

The folks in Cambridge, England said, no, you can't do that, because every time you add something, every time you add more capital to the world, it's a different kind of capital. The stuff that we're building today is different than the stuff we built yesterday, and it may not follow the same rules. And so they said these equations that you're making to simplify the world are worthless.

And essentially, the American economists won, because their way of doing things was more tractable. It was easier to use, right? You could give it to a planner and say, here, use this equation to predict what's going to happen in the world. And the folks in England, they're trying to do things in a more complicated way. They might be somewhat right, but it's not useful to think about things the way that they do. And here's the important part. It's not just that it's not useful, it's that it doesn't really matter, right? We only need approximations to run the world at a high scale.

And I always felt like the folks in Cambridge, England were really onto something. And I'm talking, for anybody who knows this stuff, I'm talking about Joan Robinson and Nicholas Calder and Piero Sraffa and folks like that. This, I think, is evidence that they were right. That not only were they right, but that it's meaningful. That we have to pay attention to the types of capital that we're adding to the world. Because it's not just, oh, we invested 10% more than we did last year. What types of investment did we make? Because that type of investment might follow different rules. It might have different costs per square foot. It might have different implications for how that market works.

Shane Phillips 34:33

So not just a question of should we invest in machinery or roads or housing, but even within housing, a 10% increase in investment might have very different effects or benefits if it's in mostly three-story apartment and condo buildings or mostly single family homes or mostly seven or 15-story buildings.

Anthony Orlando 34:56

Right. And let's make an example about how that actually applies to housing specifically. We have lived in a world where for most of American history, we could add most new housing by going out to Greenfield, out in the suburbs, and just throwing up single family structures, simple wood structures, expanding horizontally, sprawling the cities. And that was an affordable way to build housing at scale. But, and now we're tiptoeing into other work I'm doing with Chris Redfearn at USC, as we use up that greenfield, and as we have to come back more to the city core to find land, and we have to do infill, and we have to do multifamily, it might not just be that we're building taller buildings or we're building in different locations than we used to. Those things are true. But it might mean that we are doing completely different kinds of construction, and that the future of our housing production might follow different rules than it has in the past. And that's why Mike and Chris and I all think that we should be spending more time researching multifamily housing, because most of our experience is studying single family housing. And some of the rules may apply, but not necessarily all of them.

Shane Phillips 36:07

I get asked a lot the question of, you know, who's doing this well, who's doing infill in particular well in the United States? And I don't really have an answer. I think it's not going well almost anywhere. Almost every place that is relying on redeveloping existing already developed land to meet their housing needs is falling short. Seattle has done better at this than most places, also in the face of more demand than just about anywhere in the country, and so they still have been unable to keep up. But we're just so locked into this suburban model where there's a lot of things that go into it. Of course, it's just the zoning and things like that. But I think also the way we fund infrastructure improvements, you know, in greenfields, it's built around, I'm going to build hundreds or thousands of units all at the same time. Nothing has been here before except open land or agriculture. So I'm going to build as the developer, all of the roads, all of the utilities, everything. And that's perfectly reasonable. Now when you want to build a 10 story or 50 story apartment building in the neighborhood next to downtown, you're also expected to provide all of these infrastructure upgrades that are benefiting an orders of magnitude more households than the ones who actually served by that upgraded sewer line in the middle of the street, for example. And we just haven't adapted to that. And it's a real disadvantage for those projects. It's just one of many examples of I think how the paradigm needs to shift and part of why almost nowhere has really gotten there yet.

Anthony Orlando 37:35

And it's harder, right? I mean, I know we like to criticize cities. You and I could sit down and talk for a long time about how we wish every city in America did things differently. But what you're describing is fundamentally harder than the way that we used to build this, right? You have so many more existing stakeholders that you have to take into account. And it's right that we take them into account. And so we might just have to get on board with the fact that it's going to be harder no matter what we do. There was a brief time in the middle of the 20th century when we figured out how to build at scale and infill, and it was called urban renewal. And it had terrible effects, right? So we don't want to do it that way. And that means we have to be more respectful of communities, and that just means it's going to be harder.

Shane Phillips 38:13

Well, I want to come back to one more question on figure one. So it shows how costs increase across height as the building assembly is held constant. But I think this might understate the change in costs as building height rises, because in the real world, assemblies are not held constant, right? A steel or concrete structure is required for buildings eight stories or taller, but you wouldn't typically build an apartment that's seven stories or less out of those materials because it's just not the most economical choice. So moving from seven stories to eight stories or more, what you'd actually do is transition from a mostly wood substructure with relatively low cost per square foot to a substructure that's mostly concrete or steel, which is considerably more expensive regardless of height. So one might read figure one thinking that as a developer thinking about what to build, you just move along one of these marginal cost lines as your building height increases. But in reality, would you be jumping between those lines on the chart as your assembly and construction type changes? And what effect might that have on the actual marginal increase in building cost?

Anthony Orlando 39:22

You might be, but I think it's even a little more complicated than you were saying, because figure one has a line for the least expensive assembly. That actually does jump framing structures, right? Because at each height, what we're looking for is what is the least expensive assembly type that a contractor or developer might choose. And so at some heights that's going to be wood, at some heights that's going to be concrete, at some heights that's going to be steel. So there is some jumping happening there, but it's also the case that they might not always pick the least expensive assembly type, because they might have other considerations in mind. I mean, the least expensive might not be the best way to attract the high paying tenants, for example, it might not be what the owners are looking for. And so one of the reasons why we provide a range of estimates ranging from the least expensive to the most expensive is so that you can imagine the range of those kinds of jumps that might be happening.

Shane Phillips 40:15

Got it. So Anthony, you make an important point that the type of housing that gets built ultimately depends on what developers are willing to pay for land, what is known as the residual land value. The residual is basically the present or capitalized value of the revenues they expect to get from the project over time, let's just call that the value of the completed project, minus the cost of development, including construction and profit. What's left over is what they can pay for land and whatever project type produces the highest residual on a given plot of land is likely to be what is built there. I feel like your paper does a great job of explaining how construction costs interact with demand for housing and land to determine the most economically feasible building type, whether it's single family homes, three or seven or 20 story multifamily buildings, or in some cases, nothing at all. Could you share some of that, including how the building types that produce the largest residual land value differ so dramatically between places like Cleveland, Charlotte, and Boston?

Anthony Orlando 41:14

Yeah, with this part of the analysis, we're doing something similar to a feasibility analysis that a developer would actually do. We've got information about the average or median rents that you can actually earn in these markets. We've got all the information about construction costs in our model. And as you said, we're able to back out what you'd be willing to pay for the land given that you can earn those rents and that you have to pay those costs.

So a city like Cleveland is a city where the land is not very expensive compared to here in LA or a lot of other cities. There we find that the willingness to pay for land is less than the median price for single family land in the median zip code. What that means is, and we didn't calculate the land price data, the Federal Housing Finance Agency provides that stuff. And it's important to note, they are using single family data to measure that land value and that matters because one of the questions we're interested in here is, what would it take to turn a single family plot into multifamily? Would you be willing to buy that single family plot for what it costs and as a developer build something taller on it? And the answer in the median zip code in Cleveland is no. At every height, two, three, four, five, six, all the way up to 12 stories in Cleveland, you wouldn't be willing to pay more than what people are willing to pay for single family housing on that land. And so there's no impetus to build multifamily housing. And that willingness to pay, you can see that it goes down as the height increases. And so what that means is that it doesn't make sense to build a two story structure and it really doesn't make sense to build a 12 story structure.

What you have here is you have kind of a competition between the capital and the land costs. You've got a competition between how much it costs to build taller buildings, which is more, and the land costs, which in some areas are gonna justify that more and in some areas aren't. And on top of that, you've got the problem that we've talked about before, which is that it's not a smoothly changing line. So the willingness to pay is gonna have jumps just like the construction costs had jumps. So when the construction costs go up from three to four stories, people are gonna be willing to pay a different amount for the land because suddenly they have to pay more for construction costs and so they're gonna have less money left over to pay for land. And so we see all of that happen no matter which city that we're looking at.

Now if you go from Cleveland to a slightly more expensive city like Charlotte, North Carolina, you find that the willingness to pay is going to follow different rules depending on the height. So as we go from two to seven stories, the willingness to pay for land is greater than single-family housing, which means that for buildings of that height, it makes sense to buy the single-family land in the median zip code and to build a taller structure on it. But once you jump up to eight stories where we know we have that jump in construction costs, now the construction cost increase is so great that now there's not enough money left over to pay for the land and so that land will just stay single-family unless you can build at a smaller height. And so in that zip code in Charlotte, we would expect to find buildings somewhere in the two to seven story range.

In a really expensive city like Boston, we find that no matter what height you're looking at, the willingness to pay for land to build multifamily is greater than what it currently costs for single-family. And so in that median zip code, it always makes sense to buy the single-family land and convert it to multifamily because as expensive as that is, the value you're gonna get from that building is so much greater in terms of the average market rents that people in Boston are currently paying. And so in Boston, it makes sense to build a very tall building.

Now let me just caution in all of that and reiterate that we're talking about the median zip code. So that doesn't mean that there is no land in Cleveland where it makes sense to build apartment buildings. Of course there is. But the average neighborhood in Cleveland, it doesn't make sense. You've got to go to the much more expensive areas and that's why you see that the tall new structures are concentrated in small areas relative to the entire size of Cleveland. Whereas in Boston, there's a lot more of tall structures that you see.

Shane Phillips 45:33

Yeah. And the charts you produced for this are really interesting for various reasons. But one thing I just want to highlight here is it's not just comparing the different heights to each other. So in some cases, in some places, the three-story or seven-story building can pay more for land than someone who just wants to buy the single-family home. In other places, that's not the case. But you're also looking at just at what point do these different project heights become feasible because a four-story or seven-story apartment building might be able to pay more for the land than someone who just wants the single-family home. But that doesn't mean that they can actually build that thing profitably. So it still doesn't mean it's going to happen. It just means that at least compared to a single-family home or a smaller building, it might be more feasible, closer to feasibility.

Well, I want to be sure that we talk about some of the policy implications of this research. And one obvious area is height limits. There's a really interesting point that you make that I had not considered before that even if developers are building projects below a city's height limit consistently, let's say the height limit is 10 stories and they are just only building seven-story buildings or shorter, even if something like that is happening, the height limit may still be constraining building heights and increasing the rents or sale prices developers need to charge in order to turn a profit. Could you walk us through that and some of the relationship between height restrictions and breakeven rents more generally?

Anthony Orlando 47:03

Sure. So one of the issues that you're pointing to is you might look at a city and you might say, okay, the height limit is six stories in a particular neighborhood, but the new developers are building three and four stories. So what's the problem? The height limit is not constraining them. We don't need to raise the height limit. We're not going to get any additional housing units out of it. We're not going to get any additional value.

The problem with that is, and this is where I come back to, that would be true if Paul Samuelson was right that these curves were smooth. But because adding capital at a certain point materially changes the type of capital that you're building and the costs, you have these jumps that we saw in the cost function. And so what you might have happening is take a look at the jump in costs from seven to eight stories. That jump in cost from seven to eight stories means that it might make sense for you to build seven stories, but you wouldn't want to build eight, nine, or 10 stories because they're so much more expensive. You might not even want to build 11 stories, but you might want to build 12 stories because at that point you finally might be earning enough rent that you actually can make more money than the seven-story building, and you make up for that giant increase in costs that you had when you went from seven to eight stories.